Relinfra can easily received 75% of the arbitration award money including interest few years before itself if it really wanted. Niti Ayog suggestion about giving 75% of arbitration award money was given in 2016 itself.

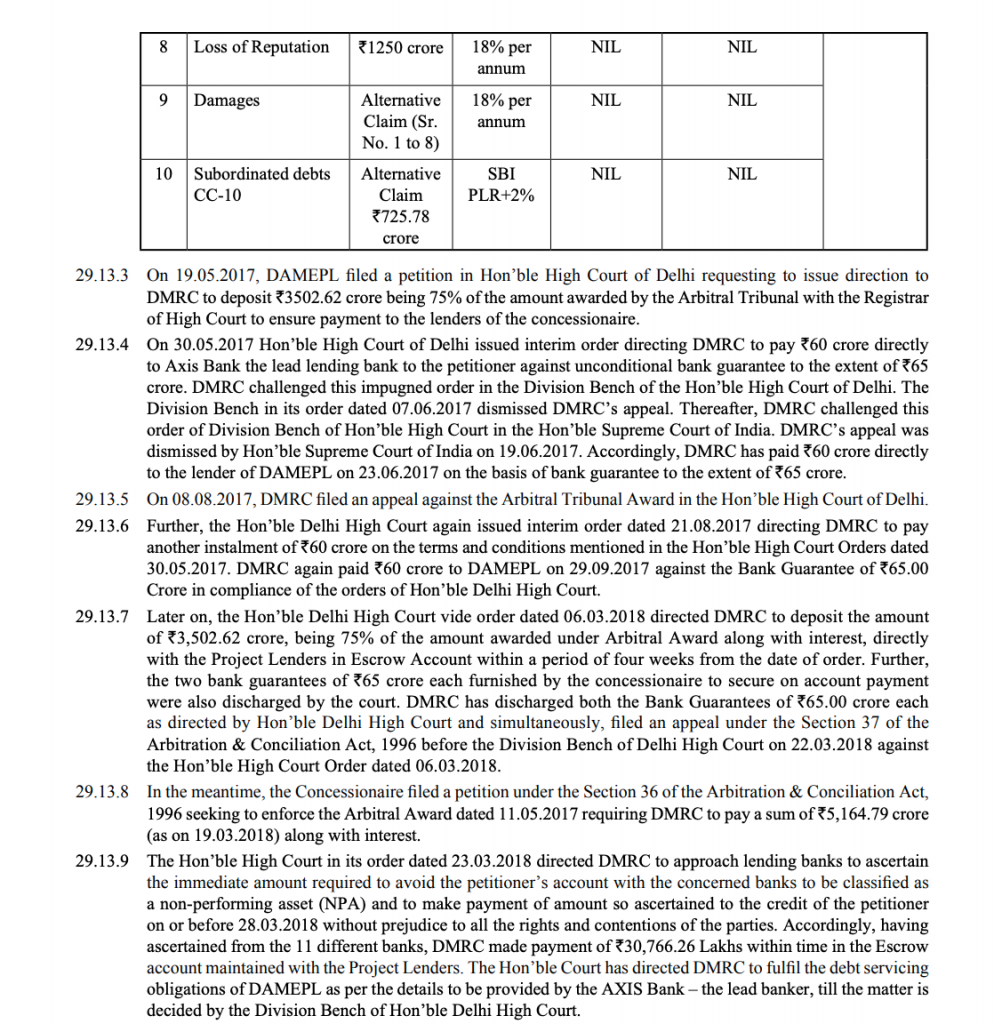

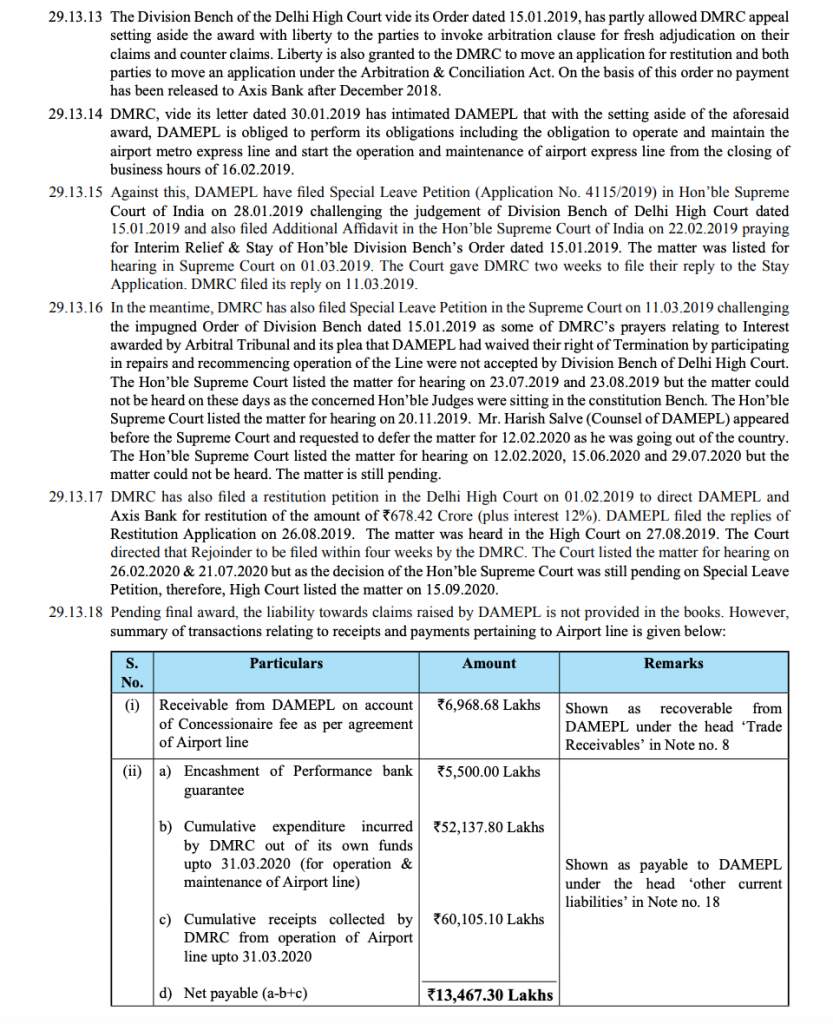

Relinfra won the arbitration award in 2017. After it won it filled a case in delhi hc asking DMRC to return 75% of the arbitration award by that time 75% of the award with interest was around Rs 3500 crore. This was in May 2017.

DMRC went for appeal and paid around Rs 600 crores to Banks as they started marking Relinfra account as default. Then Relinfra informed that it wont ask the payment till the appeal succeed. If Relinfra pushed locally then definitely it might have received the amount by that time itself. But it did not push that much.

I see there are two main reasons for that. First one is AA wanted to get this after he cleared his mess. He wanted to offload his holdings and gain it back through his family to avoid any issues might arise due to Rcoms personal guarantee. Vijay Mallaiya is the best example.

AA wanted to avoid any such situation. He know he wont have any issues as long as this govt is in rule. But if govt had changed then he might get trouble. So safer side he is doing that. In such condition if he receives the amount early and make the company debt free then it will be difficult for him to bring down the prices and do this changeover. Second important thing is interest rate DMRC has to pay when they delay payment.

If it is lower than what Relinfra is paying to its lenders then definitely it is better to get the money as quick as possible and pay to the lenders. But interest rate is higher. So they wont lose anything even if they receive the amount after few years. One more important point to note here is to get the 75% of the amount company has to give BG equal to the 75% amount it receives. That also will be a extra burden. Because Relinfra has to pay some bank guarantee fee till its returned. Why unnecessarily paying this BG fee when it is going to get a better interest rate in the delay period. So it is a better move of just waiting for DMRC to return the money at one point. In this process the real loser is public because of DMRCs mismanagement.

They should have atleast paid the 75% amount in 2017 itself. If they had done that they might have saved at least 2000 crore interest that they have to pay extra. Even now they do the foolish thing. Because DMRC can get loan for less than 2% annual interest whereas they now pay almost more than 14% interest to Relinfra for the delay payment. Complete waste of people money. Relinfra will benefit huge.

Now this SC verdict and insertion of new rule 227A in General Finance Rules 2017 – Arbitration Awards all seems that DMRC is preparing for the full payment to Relinfra. I hope it will flow into Relinfra soon. DMRCs finance department has already prepared plan for that and put it into managements view already. They have done this in their meeting after SC verdict. DMRC has more than 10k crore of fixed deposit amount. So it will not be a problem for them to clear Relinfra dues in one shot.

Most important thing is DMRC is owned 50% by President of India which means Union government and 50% is by Government of Delhi. We know the relationship between Ambanies and present govt. So he will easily get the amount but it will come when he want to pumb that into the company. I hope AA will do that soon. Stay long here. Huge returns are awaiting.

MUMBAI: Reliance Infrastructure NSE -3.07 % has filed a petition with the Delhi High Court seeking early payment of arbitration award that it won recently for its subsidiary Delhi Airport Metro Express Private, the company said in a statement on Wednesday.

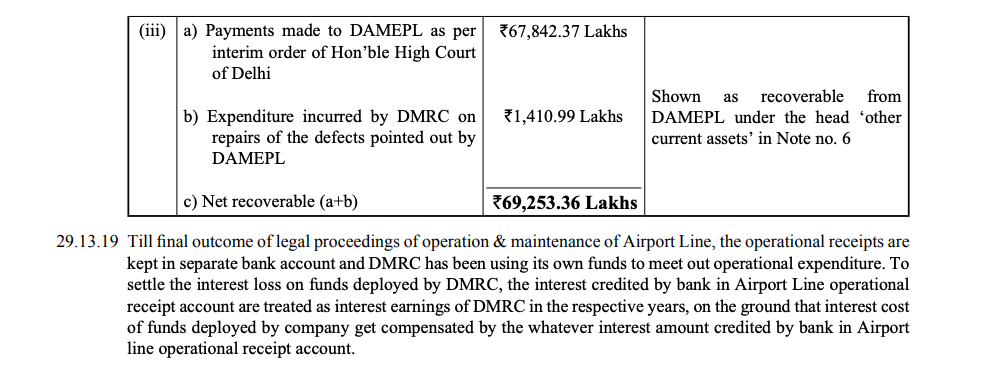

The Anil Ambani-led company said that it will get a total compensation of Rs 4,670 crore, which includes the penalty and the interest on it, from Delhi Metro Rail Corporation.

“Under government of India approved guidelines issued by Niti Ayog vide their office memorandum dated September 5, 2016, public sector undertakings are to pay 75% of the award amount, even if they propose to challenge the arbitral award. RInfra is thus expected to receive Rs 3,500 crore as per the above guidelines,” the company said in the statement.

Earlier this month, Delhi Airport Metro Express won an arbitration against Delhi Metro Rail Corporation for the termination of the concession agreements for the project. In 2012, Reliance Infrastructure, which had the contract to develop and operate the metro express project in the capital, terminated the contact citing DMRC had failed to fix the civil structure defects in the project. The company subsequently sought compensation and the dispute was referred to arbitration tribunal.

After hearing the case for almost three and a half years, the Arbitration Tribunal, formed out of a DMRC nominated panel as required by the concession agreement, granted a verdict in favour of Reliance Infra. The company, which has a consolidated debt of Rs 16,000 crore, aims to use the proceeds from the arbitration award to repay debt of eight public sector banks and also pay back the parent company for its investment in the project.

Reliance Infra has put a stop on project development business to focus more on cash contracts. In 2012, Reliance Infrastructure, which built Mumbai’s first Metro rail line, had exited from Mumbai’s Haji Ali-Worli sea link after a dispute with authorities. Reliance Infrastructure also exited second phase of Mumbai metro project.

Tamil books Online

Tamil books Online